This is Gareth’s story

At age 30 I went to a financial advisor to see what options I had for my super fund. Until then I had one of those standard HostPlus super funds that everyone gets when you get your first job. I hadn’t taken much notice of it until I had a few grey hairs starting to appear. A reputable firm, managed by a reputable team yet pigeonholed into selling financial products the same as everyone else.

I was asked to complete a risk profile which basically put me somewhere between below average risk and above average risk depending on the questions I answered in that 30 minute meeting. No thought was given to a 30 year investment plan, what the world would look like in 30 years or how the financial markets might change over that time.It was all very much about selling me a package.

I sat back and thought to myself, I’m sitting in a fancy office, in front of a fairly young (nothing wrong with young people) person who had a wife and kids to feed and I couldn’t help but think “if this financial advisors advice was the best in the world, why would he need a job selling it to me?”

This was my epiphany moment, where I thought “there must be an alternative” and led me to a search in Google on alternative investment options. I was presented with many options. A lot of crap, a lot of big claims, a lot of very alternative ideas like bitcoin, cfd trading, collectibles, wine investing, real estate, options, coins, bonds, mineral rights, fixed annuities, airplane leasing. The list was endless.

However through this research I stumbled upon Non Correlated Capital. I met with the investment manager and without ever feeling ‘sold to’, he spent a lot of time explaining to me why the fund invested in certain ways and how the fund had the flexibility to change direction and adapt with the ever changing financial market.

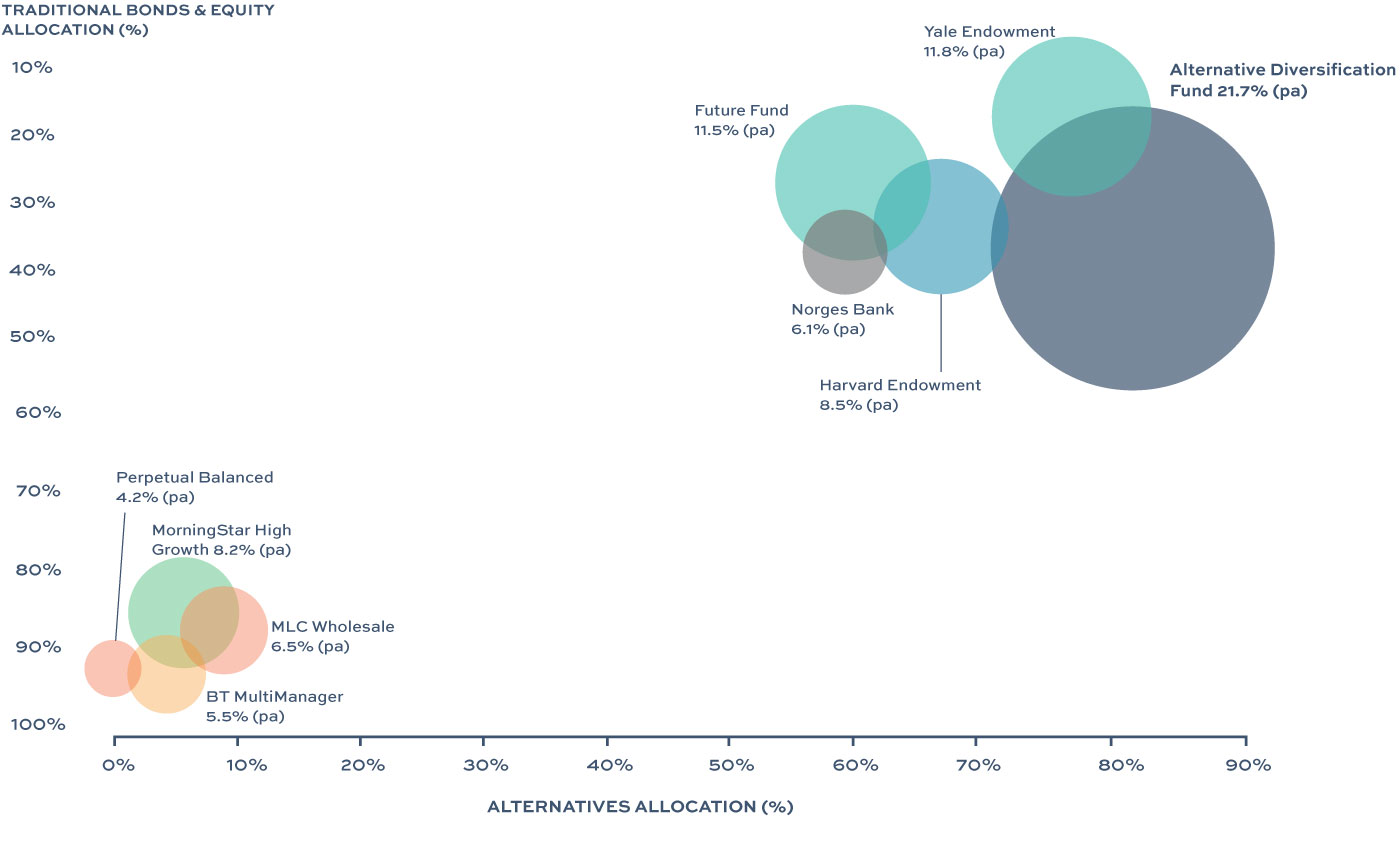

The second thing I liked about NCC’s Alternative Diversification Fund is that the investment managers took all the responsibility out of reviewing and analyzing the endless list of investments that were available and gave me a sense of security that someone who knew what they were doing had just as much of their own money committed to the investment as I did. They did not try to suggest they had the next big thing or that they had some exclusive access to a product no-one else had, it was a fair and considered approach to spreading risk amongst investments, a true ‘fund of funds’.

Yet what really caught my attention was that many of their funds were exclusive to “Wholesale Investors” “What is a wholesale investor?” I asked.

Well turns out, myself, like many others, qualify as a wholesale investor! And this where the fun begins, once you know that you are a wholesale investor, a mountain of new investment opportunities present themselves.

Yes there are rules, yes there are risks, yes you do have to qualify but my little mate the financial advisor never told me this. It wasn’t even mentioned, yet he had all the knowledge to know that I would have been. I believe this is because they wanted me to buy their products and not someone elses.

I left the meeting feeling fresh, yet annoyed that I didn’t know this whole other world of investment opportunities existed.

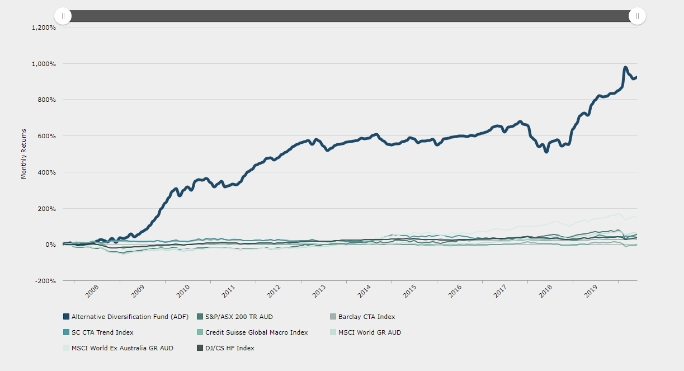

I look back at this after a year investing in NCC’s Alternative Diversification Fund and I have achieved my goals

– I have avoided all eggs in one basket

– I have avoided fees where possible

– I have total control over a portion of my investments

– I have invested in both traditional and alternative investments

– I have avoided financial advisors fees

– Alternative Diversification Fund made 9.1% for the year compared to HostPlus fund was down -1.02%

– Alternative Diversification Fund also made 10% for the month of March 2020 (start of COVID-19) compared to the marketing being down -20%

In summary, there are 3 things that have achieved these results for me

1) Knowing that I qualified as a wholesale investor means more opportunities

2) Cutting out the middle men fees means better returns

3) Taking an interest meant I knew what to look for

I would have no hesitation recommending Non Correlated Capital and their Alternative Diversification Fund.