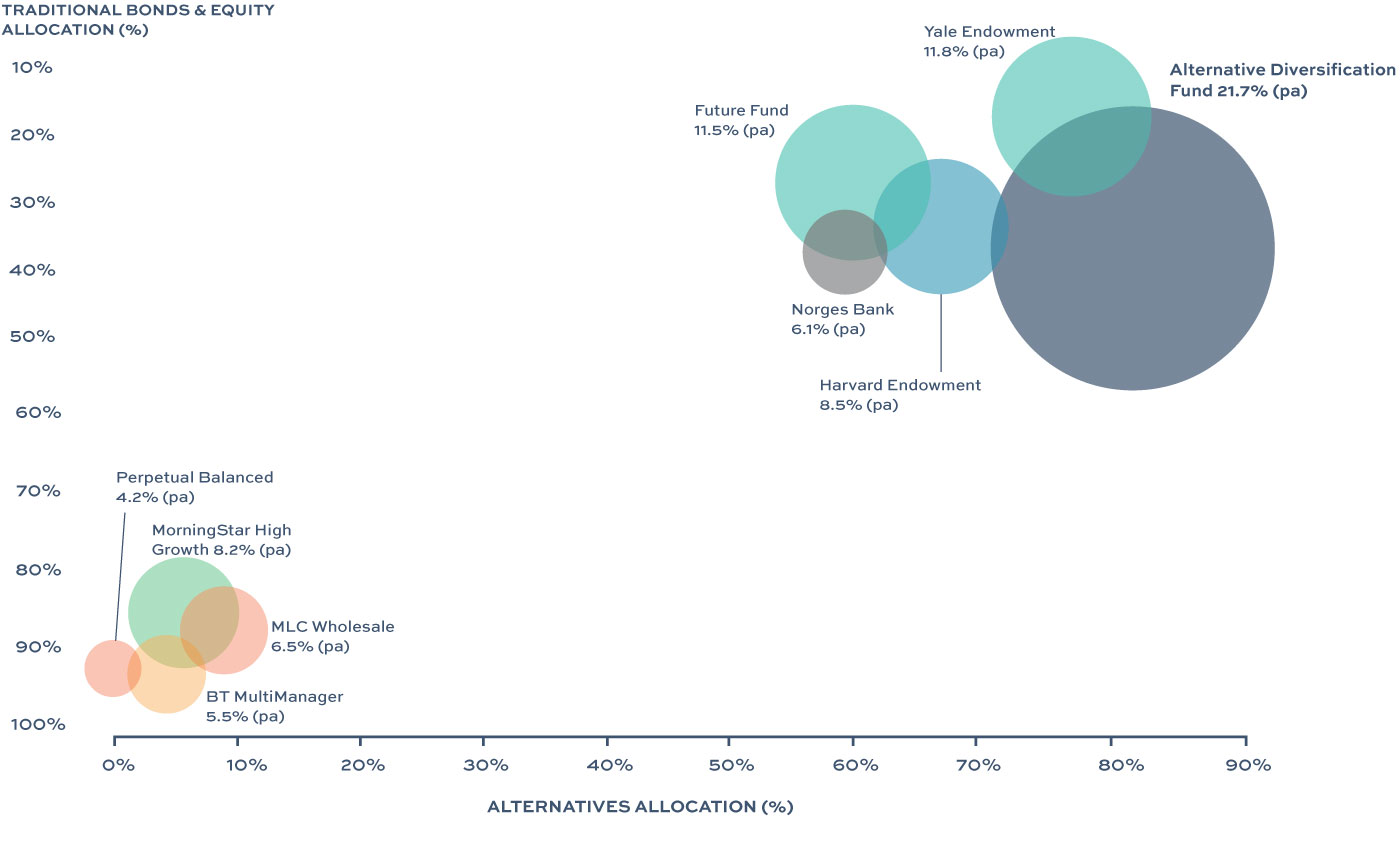

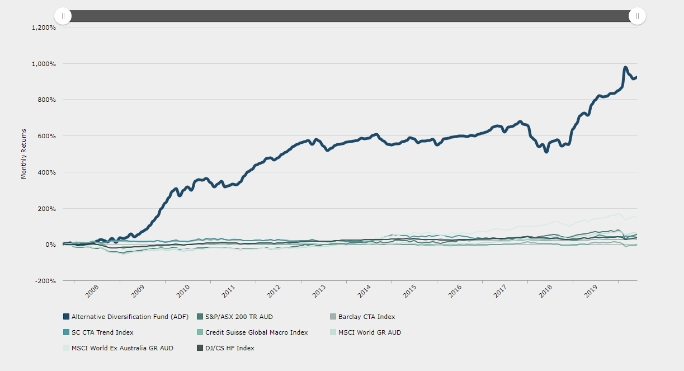

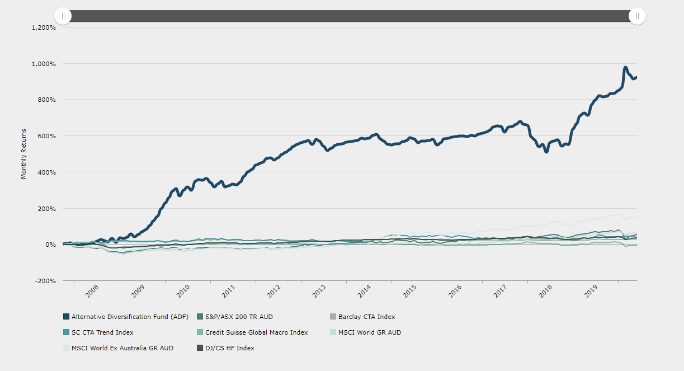

| Description | ADF is a Multi-Asset Fund seeking to achieve a better risk-adjusted return when compared to a traditional “High Growth” portfolio. The Fund seeks true diversification by selecting a broad portfolio of investments, including alternative assets, low-correlation strategies, emerging and established investment managers. |

| Investment Manager | Non Correlated Capital Pty Ltd |

| Website | https://noncorrelatedcapital.com/investments/alternative-diversification-fund/ |

| Asset Class | Alternatives (liquid) |

| Strategy Type | Multi strategy / multi manager |

| Management Fees | 0.65% p.a. paid monthly on investments ≥ $500,000 0.85% p.a. paid monthly on investments < $500,000 |

| Performance Fees | 0% |

| Minimum Investment | $100,000 |

| Description | The Apollo Capital Fund is an award-winning multi-strategy fund that invests in the crypto assets that are powering a new financial infrastructure. The Apollo Capital Fund is led by a team with a rare combination of traditional funds management and crypto asset experience. |

| Investment Manager | Apollo Capital Managemenet Pty Ltd |

| Website | https://www.apollocap.io/ |

| Asset Class | Digital Assets |

| Strategy Type | Multi asset / multi strategy |

| Management Fees |

2% p.a |

| Performance Fees | 20% High Watermark |

| Minimum Investment | $50,000 |

| Description | The Caleb & Brown Flagship Fund is a high-conviction investment strategy designed to offer investors broad-based exposure to crypto assets. It implements a long-term investment approach, complemented by active portfolio management and underpinned by a robust risk management framework. |

| Investment Manager | Caleb and Brown Capital Management Pty Ltd (CBCm) |

| Website | https://www.calebandbrown.com/ |

| Asset Class | Digital Assets |

| Strategy Type | Long only crypto |

| Management Fees | 2% p.a |

| Performance Fees | 20% subject to HWM This fee is calculated and is payable monthly in arrears. |

| Minimum Investment | $25,000 |

| Description | The Caleb & Brown Flagship Fund is a high-conviction investment strategy designed to offer investors a broad-based exposure to crypto assets. It implements a long-term investment approach, complemented by active portfolio management and underpinned by a robust risk management framework. The fund is complemented by a derivatives hedging strategy that protects against extreme market conditions |

| Investment Manager | Caleb and Brown Capital Management Pty Ltd (CBCm) |

| Website | https://www.calebandbrown.com/ |

| Asset Class | Digital Assets |

| Strategy Type | Long only crypto with derivatives hedging |

| Management Fees | 2% p.a |

| Performance Fees | 20% subject to HWM This fee is calculated and is payable monthly in arrears. |

| Minimum Investment | $25,000 |

Applications : closed – Fund 2

| Description | A specialised investment firm focussing on fast growth companies developing cloud, mobile and enterprise technological services – FNV is part of Microsoft suite of Investment opportunities. |

| Investment Manager | Future Now Capital Management Pty Ltd |

| Website | https://www.futurenow.ventures/portfolio |

| Asset Class | Alternatives |

| Strategy Type | Venture capital – technology focus |

| Management Fees | 2% per annum of Committed Capital, accruing daily |

| Performance Fees | 20% at end of the Fund term |

| Minimum Investment | $100,000 |

| Description | The Fund offers the opportunity to gain exposure to the growing mixed-use sector based on a ’Develop- to-Hold’ investment strategy. |

| Investment Manager | Greenpool Funds Management Pty Ltd |

| Website | https://www.greenpoolcapital.com/ |

| Asset Class | Property & Infrastructure |

| Strategy Type | Property Development |

| Management Fees | 0.55% p.a. |

| Performance Fees | 20% over hurdle rate of 12% p.a IRR |

| Minimum Investment | $500,000 |

| Description | The Trust provides Investors with the opportunity to gain exposure to a bustling, convenience based super neighbourhood shopping centre as a core investment with strong value add opportunities. |

| Investment Manager | Greenpool Funds Management Pty Ltd |

| Website | https://www.greenpoolcapital.com/ |

| Asset Class | Property & Infrastructure |

| Strategy Type | Property Development |

| Management Fees | 0.60% p.a. |

| Performance Fees | 20% over hurdle rate of 10% p.a IRR |

| Minimum Investment | $250,000 |

| Description | Monochrome Bitcoin Fund (‘MBF’) is a capital growth fund that offers a regulated and familiar investment vehicle designed to track the price of bitcoin. |

| Investment Manager | Monochrome Asset Management Pty Ltd |

| Website | https://monochrome.co/summary/ |

| Asset Class | Digital Assets |

| Strategy Type | Bitcoin tracker fund |

| Management Fees | 1.5% management fee |

| Performance Fees | N/A |

| Minimum Investment | $25,000 AUD |

Applications: Open

| Description | DTS is a systematic, automated, intra-day long/short equity index futures pattern system with dynamic risk management. |

| Investment Manager | Mounts Bay Capital Pty Ltd |

| Website | https://mountsbaycapital.com/ |

| Asset Class | Systematic |

| Strategy Type | Equity-like long-term upside, with lower downside risk |

| Management Fees | 2% p.a |

| Performance Fees | 20% high watermark |

| Minimum Investment | $1M |

| Description | The Fund will issue short and medium term loans to qualifying Western Australian based SMEs, with the objective of providing investors with: regular income, low risk of capital loss, attractive risk adjusted returns and the portfolio diversification benefits of participating in the currently difficult to access WA SME debt market. |

| Investment Manager | One Degree Capital Pty Ltd |

| Website | https://onedegreecapital.com.au/ |

| Asset Class | Alternatives / Credit |

| Strategy Type | SME Debt – Western Australian Focused |

| Management Fees | 1.95% pa |

| Performance Fees | 20.0% of the distributable income of the Fund above the benchmark net return payable to investors of 7.0% p.a. (exclusive of GST). |

| Minimum Investment | $250,000 and then in multiples of $50,000. |

| Description | A feeder fund into Potentum Partners main Cayman fund. A diversified portfolio of private equity and venture capital opportunities. Potentum Partners have developed innovative methodologies to identify with consistency, attractive investment opportunities, removing the reliance on luck or excessive leverage. |

| Investment Manager | Potentum Partners Australia Pty Ltd |

| Website | https://www.potentumpartners.com/ |

| Asset Class | Alternatives – Private Markets |

| Strategy Type | Private Equity & Venture Capital |

| Management Fees | 0.75% p.a |

| Performance Fees | 5% of all realised profits |

| Minimum Investment | $100,000 |

Applications: Closed

| Description | A side cart fund focusing on a concentrated portfolio of select venture capital and private equity opportunities. Potentum Partners have developed innovative methodologies to identify with consistency, attractive investment opportunities, removing the reliance on luck or excessive leverage. |

| Investment Manager | Potentum Partners Australia Pty Ltd |

| Website | https://www.potentumpartners.com/ |

| Asset Class | Alternatives – Private Markets |

| Strategy Type | Private Equity & Venture Capital |

| Management Fees | 0.75% p.a |

| Performance Fees | 5% of all realised profits |

| Minimum Investment | $100,000 |

| Description | A side cart fund focusing on a concentrated portfolio of select venture capital and private equity opportunities. Potentum Partners have developed innovative methodologies to identify with consistency, attractive investment opportunities, removing the reliance on luck or excessive leverage. |

| Investment Manager | Potentum Partners Australia Pty Ltd |

| Website | https://www.potentumpartners.com/ |

| Strategy Type | Private Equity & Venture Capital |

| Management Fees | 0.75% p.a |

| Performance Fees | 5% of all realised profits |

| Minimum Investment | $100,000 |

| Description | |

| Investment Manager | Platinum Property Funds Management Pty Ltd |

| Website | |

| Strategy Type | Property |

| Management Fees | |

| Performance Fees | 20% of MIS pre-tax dividend |

| Minimum Investment | $50,000 |

| Description | |

| Investment Manager | Platinum Property Funds Management Pty Ltd |

| Website | |

| Strategy Type | Property |

| Management Fees | |

| Performance Fees | 20% of MIS pre-tax dividend |

| Minimum Investment | $50,000 |

Applications: Open

| Description | An investment consultant who works collaboratively to create customised, smarter investment solutions that facilitate growth |

| Investment Manager | QIM PTY LTD |

| Website | https://www.quilla.com.au/ |

| Asset Class | Derivatives |

| Strategy Type | Hedging overlay only |

| Management Fees | 0.22% p.a |

| Performance Fees | Nil |

| Minimum Investment | $10,000 |

| Description | Multi strategy focusing on factors in global equities combined with a US index futures trading overlay. |

| Investment Manager | Skye Asset Management Pty Ltd |

| Asset Class | Global equities |

| Strategy Type | Long only factor trading |

| Management Fees | 1.5% p.a |

| Performance Fees | 15% subject to MSCI World IMI AUD hedged benchmark |

| Minimum Investment | $100,000 |

Applications: Open

| Description | Multi strategy fund focused on futures trading |

| Investment Manager | Skye Asset Management Pty Ltd |

| Asset Class | Alternatives – liquid |

| Strategy Type | Multi strategy |

| Management Fees | 1.5% pa |

| Performance Fees | 15% subject to MSCI World IMI AUD hedged benchmark |

| Minimum Investment | $100,000 |

| Description | VOOG is an international construction group focusing on facilitating and developing infrastructure projects internationally |

| Investment Manager | VOOG Investment Management Pty Ltd |

| Asset Class | Infrastructure |

| Strategy Type | Long only |

| Management Fees | 2% pa |

| Performance Fees | 20% of investment returns after the return of subscription capital to unit holders. |

| Minimum Investment | $100,000 |

FOR AUSTRALIAN WHOLESALE AND USA QEP INVESTORS ONLY.

This publication has been prepared on behalf of and issued by Non Correlated Capital Pty Ltd. This is not an offer to deal in any financial product. This information is general in nature and is presented without regard to any investor’s individual objectives, financial situation or needs. It is not specific advice for any particular investor. Before making any decision about the information provided, you must consider the appropriateness of the information in this document, having regard to your objectives, financial situation and needs and consult your adviser. The value of investments and any income generated may go down as well as up and is not guaranteed. Past performance is not necessarily a guide to future performance. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. Investors should be aware of local laws governing investments and should read all the relevant documents. Please visit www.noncorrelatedcapital.com and fill out a contact form to gain further information.